Energy Prices and Recent Events

There has been much comment and speculation in recent weeks about energy prices and supplies of certain fuels, most notably natural gas. In this article, Inspired Energy’s Market Analyst Lewis Godfrey examines what has happened and what it means for Build to Rent operators and residents

What has happened?

The price of the energy we use normally follows the pattern of the cost used to generate it. Gas is a significant contributor to UK electricity generation as well as being used in boilers in homes, in cooking appliances and so forth. Normally in Winter as heating gets switched on and we naturally use more electricity for lighting and other purposes, the residual capacity for additional gas supply falls.

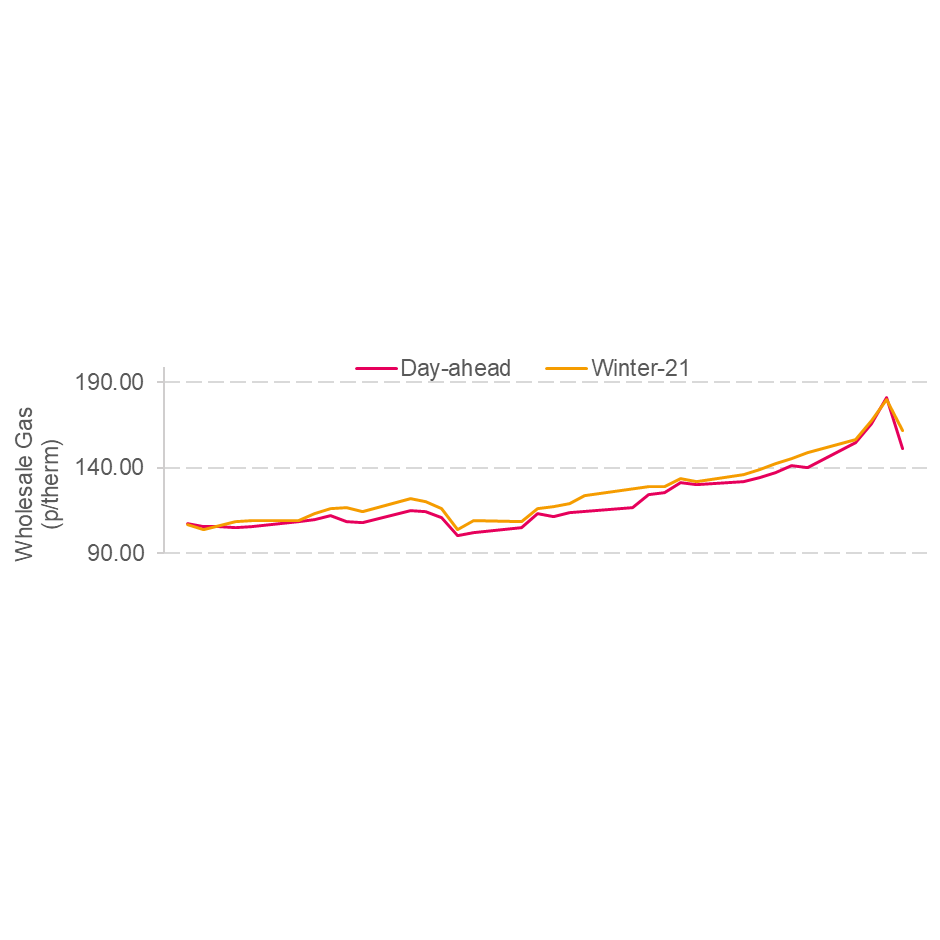

Figure 1: Day-ahead and Winter-21 period valuation for UK Gas (top)

This winter, there are concerns about the residual capacity since stored gas on a regional level has been used already, we are witnessing lower than normal imports of liquified natural gas and there are mixed sentiments in energy markets around the RUS-GER Nord Stream 2 gas pipeline. Figure 1 shows how the market is currently pricing UK Gas.

Can’t Other Energy Sources Tackle any Shortfall?

Not of late. Weak renewable and limited nuclear generation have meant that the suppliers of electricity have had to rely on gas and coal-fired electricity generation, which are more expensive options. Many suppliers cannot see at present this situation changing over the winter, meaning that costs are likely to remain high over the winter and likely into next year.

Figure 2: UK Baseload Power

To compound matters, a power interconnector caught fire on 15th September, which took with it 1GW of import/export capacity, which provided a means of import/export of electricity. This, too, has started to be priced in to energy prices, and National Grid has confirmed that it does not expect the interconnector to be fixed until March 2022.

What does this mean for BTR Operators and Developers?

Such severe market volatility may be incentivizing consumers to hold off on making procurement decisions. Inaction in such a turbulent market adds further budgetary risk, with out-of-contract levels at a premium to contract terms prior to the delivery window.

It is also worthwhile for operators to take inventory of the amenities that are provided centrally within their communities, and to make contingencies in case problems should worsen. It is envisaged that many of the plans put in place for the pandemic could be repurposed for this.

Understanding deferral risks and keeping up-to-date with market dynamics is critical to limiting potential risks to your business. To find out more about how Inspired Energy can help you navigate an extremely volatile market, speak to Wayne Brown on 01772 689250 or email [email protected]

What does this mean for residents?

Many residents will purchase their own energy directly from a supplier. Consumer champions such as Which? confirm that many consumers do not check whether they are on the best available tariff for themselves, even within the range on offer by their own energy supplier. In the event that residents make contact, or should you wish to proactively, you might refer them to consumer advice such as that provided by Which? At the link below, that guides consumers on how to ensure that they can access the best energy prices: